Life Insurance Corporation of India (LIC) offers a range of insurance policies to cater to the diverse needs of its customers. One such policy is LIC New Jeevan Anand (Plan 915), which has garnered significant attention due to its dual benefits of insurance and savings. In this blog post, we will delve into the details of LIC New Jeevan Anand and explore how you can calculate premiums and maturity benefits using the LIC New Jeevan Anand Maturity Calculator.

| Jeevan Labh Plan (Table-936) | |

| Age | 18-50 Years |

| Policy Term | 15-35 Years |

| Maximum Age At Maturity | 75 Years |

| Maturity Amount After Completion of Policy Term | Basic Sum Assured + Accumulated Simple Reversionary Bonus (Bonus) during Policy Term + Final Additional Bonus (FAB) |

| Post Maturity Life Cover | Basic Sum Assured (After Maturity, whenever death happens, the nominee gets Basic Sum Assured). |

| Death Claim Amount During Policy Term | Death Sum Assured + Accumulated Simple Reversionary Bonus (Bonus) till the time of Death + Final Additional Bonus (FAB) + Term Rider Sum Assured (if Opted).

Additional Accidental Rider Sum Assured in case of Accidental Death (if opted) |

| Death Sum Assured | 125% of Basic Sum Assured or 7 times of Annualised Premium, whichever is higher. |

| Available Riders | Accidental and Disability Benefit Rider, Term Assurance Rider, Accidental Benefit Rider |

| Surrender and Loan | Available if, all premiums of First 2 Years are paid. |

| Tax Benefit | Premium is exempted (80c) and Maturity/Death Claim is Tax Free (10(10D)) |

LIC New Jeevan Anand Maturity Calculator Overview

LIC New Jeevan Anand is a popular endowment insurance plan that provides financial security to

policyholders and their families. It combines the features of a traditional endowment policy with

the advantage of whole-life coverage. Here's a brief overview of the plan

- 1. Dual Benefits: The policy offers both death and maturity benefits, making it an excellent choice for individuals looking for financial protection and long-term savings.

- 2. Flexible Premium Payment: Policyholders can choose between various premium payment frequencies, including yearly, half-yearly, quarterly, or monthly, according to their convenience.

- 3. Maturity Benefit: The plan provides a lump-sum maturity benefit at the end of the policy term, which includes the sum assured and accrued bonuses.

- 4. Death Benefit: In the unfortunate event of the policyholder's demise during the policy term, the nominee receives the death sum assured along with vested bonuses.

Benefits of Using the LIC New Jeevan Anand Maturity Calculator

The LIC New Jeevan Anand Maturity Calculator is a valuable tool that helps policyholders estimate their premium payments and the maturity benefits they can expect. Our tool offers several advantages:

- 1. Accurate Estimations: The calculator provides precise premium and maturity benefit estimations, helping you plan your financial future effectively.

- 2. Informed Decision-Making: With the calculator's insights, you can make an informed decision about whether the LIC New Jeevan Anand policy aligns with your financial goals.

- 3. Comparison: You can use the calculator to compare different premium payment frequencies and policy terms to find the most suitable option for your needs.

Understanding LIC Premiums Calculator

Now that you have an understanding of the plan, let's explore how you can calculate premiums and maturity benefits using the LIC New Jeevan Anand Maturity Calculator.

1. Policy Eligibility

Before delving into the details of this plan, it's essential to understand the eligibility criteria for LIC New Jeevan Anand. Typically, individuals aged 18 to 50 years can apply for this policy, with the maximum maturity age being 75 years. The policy term can vary from 15 to 35 years, allowing policyholders to choose a term that suits their financial goals.

2. Premium Payments

Policyholders can choose from various premium payment frequencies, including yearly, half-yearly, quarterly, or monthly. The flexibility in premium payment options makes it convenient for individuals to manage their policies according to their financial capabilities.

3. Sum Assured

The sum assured is the amount that the policyholder's nominee will receive in case of the policyholder's demise during the policy term. The sum assured depends on the premium amount chosen by the policyholder and their age at the time of policy purchase. It's important to note that the sum assured is a crucial factor in determining both the premium amount and the maturity benefit.

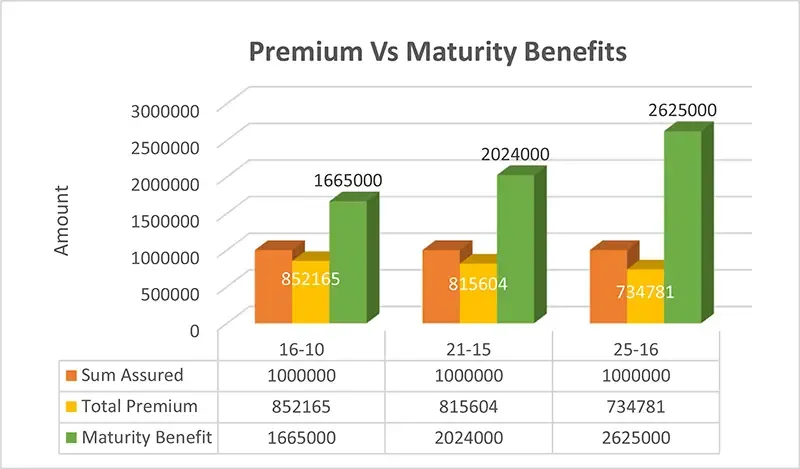

4. Maturity Benefit

The primary attraction of LIC New Jeevan Anand is its maturity benefit. Upon the policy's maturity, the policyholder is entitled to receive the sum assured along with any bonuses that may have accrued during the policy term. The bonuses are typically declared by LIC and add to the overall maturity benefit, making it an attractive option for long-term savings.

Conclusion

In conclusion, LIC New Jeevan Anand is a versatile insurance plan that offers the dual advantage of protection and savings. Using the LIC New Jeevan Anand Maturity Calculator, you can easily determine your premium payments and the expected maturity benefit, empowering you to make a well-informed choice that secures your financial future.

Don't forget to consult with LIC agents or financial advisors to gain a deeper understanding of the policy and its suitability for your unique circumstances. Start planning for a financially secure future today with LIC New Jeevan Anand!